Promotions

ប្រូម៉ូសិន

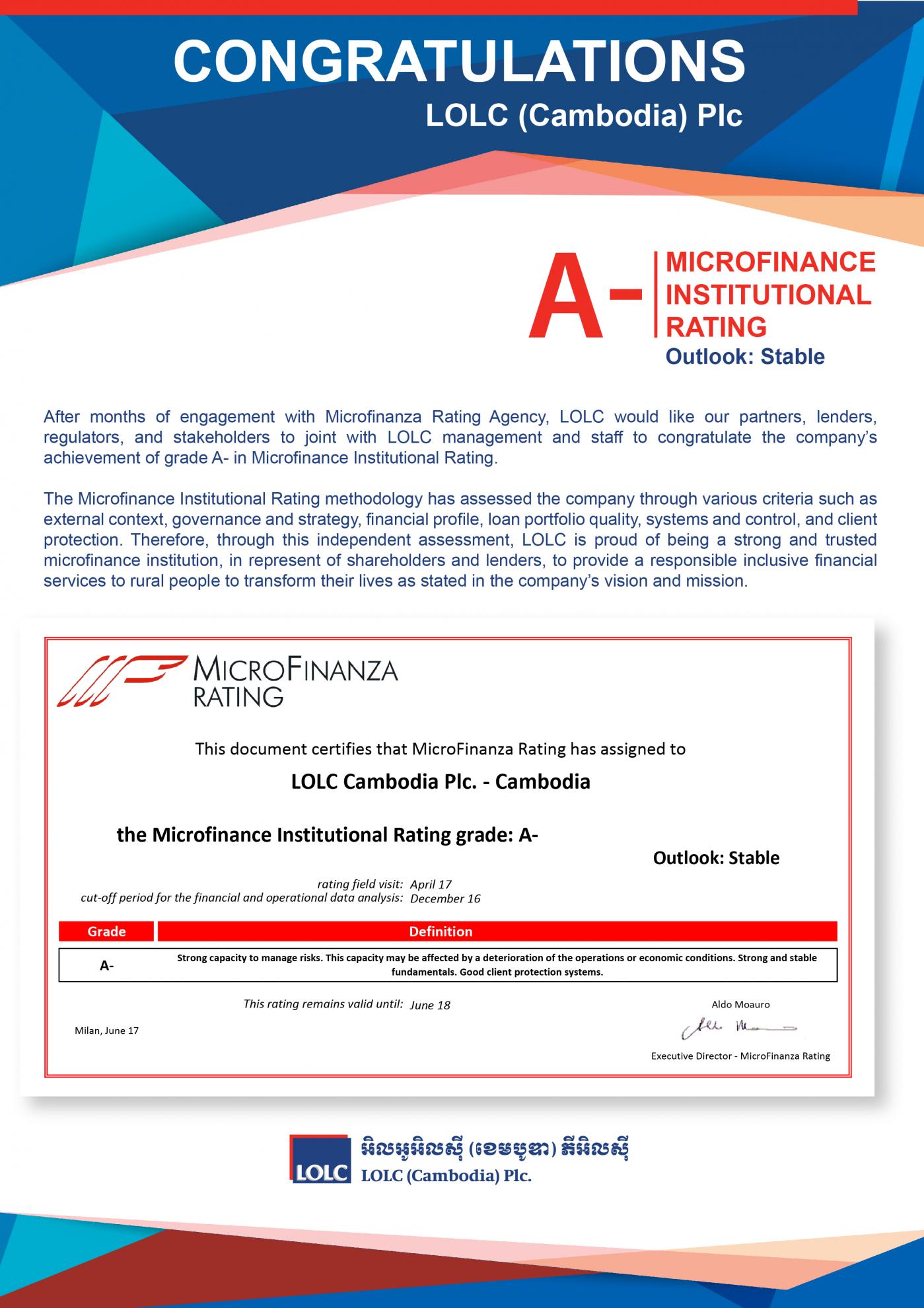

LOLC to receive grade A- in Microfinance Institutional Rating

LOLC Cambodia, a microfinance institution, has reported assets of more than $1 billion as of December last year, according to its quarterly and yearly report.

The report stated, its loan portfolio has increased to $779 million, up 62 per cent compared with the end of 2018. In one year, the number of borrowers also increased by 25 percent to 294,152 while its portfolio risk ratio was lower than the industry average, at only 0.61 percent. It also noted that its deposit balance reached more than $448 million, a 95 percent increase compared with the previous year, while the number of depositors reached more than 336,000 an 86 percent increase in the same time frame.

“Fast growth for both portfolio and deposit balances have reflected our trustworthiness because we are offering excellent customer service, guaranteeing client protection and providing competitive and innovative deposit and loan products,” said Sok Voeun, LOLC Cambodia chief executive officer. The company has also raised $20 million for the growth of its lending business, expanding its operating network to 79 branches across the country.

Sok said, LOLC is focusing on technology-oriented delivery channels that will improve customer service and increase efficiencies, such as ATMs, mobile banking applications and third-party connections.

“We will try to make the most out of the opportunities that our current successes open for us. We are confident that LOLC is well-positioned to bring further value to its customers, investors and shareholders,” Sok said.

Source: Khmer Time

Related Post

LOLC (Cambodia) Plc. has been serving Cambodian public and society for over 30 years, and has been recognized by both local and international financial authorities. Our products and services are committed to improving the livelihood of Cambodian customers.

©Copyright 2026 LOLC (Cambodia) Plc , All Rights Reserved

Information Security

Information Security