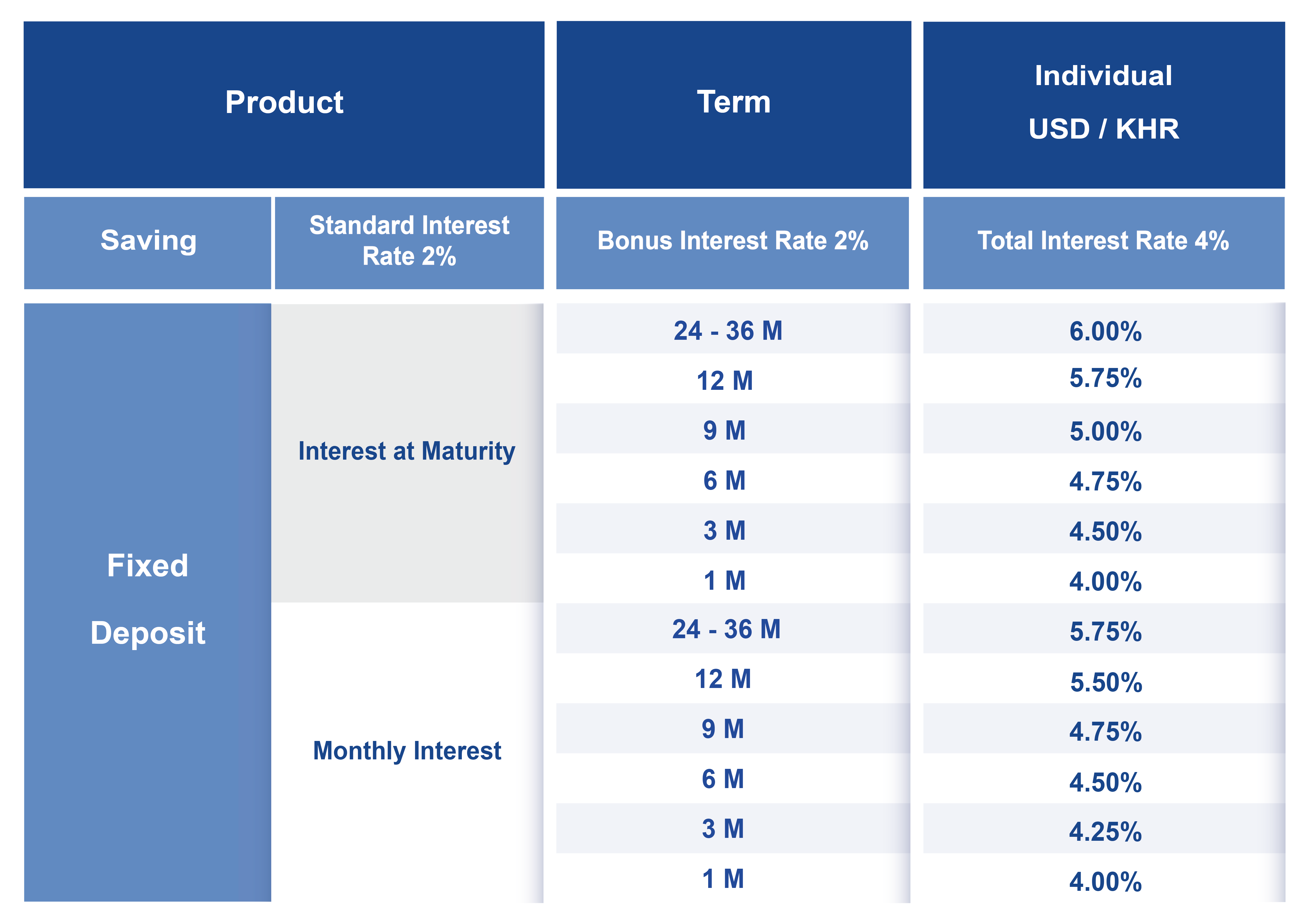

A Fixed Deposit Account offers a greater rate of return for clients’ commitment in keeping the savings on deposit with LOLC Cambodia for a specific period of time. Clients have the option to withdraw interest at the end of each month or at the end of the term.

Benefits:

- Get high interest income

- Your money will be kept safely and securely

- Multiple currency choices: KHR and USD

- Open an account at any LOLC office without service charge

Information Security

Information Security