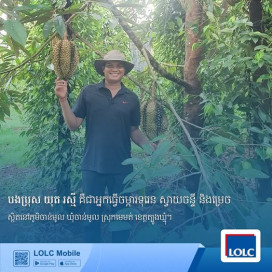

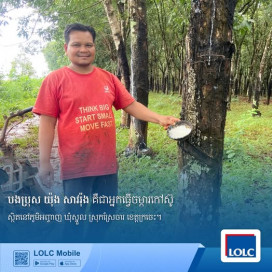

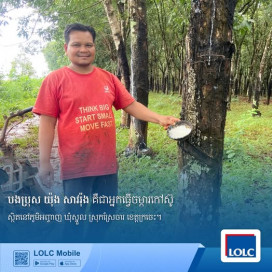

Located in the northeastern highlands of the Kingdom of Cambodia, most families rely on farming for their livelihood. They commonly grow rubber and cashew trees, which are well suited to the soil and climate of the region. Among the farmers in this area, Mr. Yong Savrong, a model farmer from Snuol District, Kratie Province, has gained the attention of fellow farmers in the community due to his success in transforming his livelihood through the smart use of loans from LOLC (Cambodia).

In the beginning, Mr. Savrong was just an ordinary farmer, cultivating rubber on a small plot of land like many others. However, driven by hard work and a desire to build a better future, he began studying the market and the potential of rubber farming. He later decided to expand his plantation to increase both yield and household income.

In 2020, he applied for a loan of 4,000,000 riels from LOLC (Cambodia) to purchase fertilizer to improve the growth of his rubber trees. Later, in 2021 and 2023, he applied for additional loans to purchase more land for expanding his rubber plantation, as well as land for growing cashew trees. A portion of the loan was also used to buy rubber and cashew seedlings for planting in his fields.

After many years of dedication and with the support of reliable financial services, Mr. Savrong began harvesting rubber and cashew crops that produced highly satisfying yields. Today, he owns 5 hectares of rubber plantation and 2 hectares of cashew plantation, a remarkable improvement compared to his situation before using LOLC (Cambodia) loans.

Mr. Savrong shared, “A loan does not make our lives difficult. Instead, it is a form of financial support that helps improve our family’s livelihood, if we use it correctly and for the right purpose, with a clear business plan, proper utilization, and discipline in financial management”.

The success of Mr. Yong Savrong demonstrates that using loans responsibly, with proper planning and careful consideration, can significantly improve living conditions as the business continues to grow.