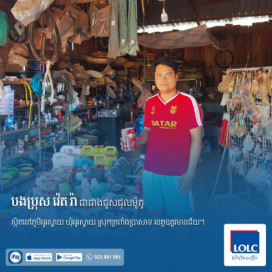

Mrs. Tem Phun is a businesswoman in Pong Tuek Village, Prey Rumdeng Commune, Mesang Ddistrict, Prey Veng province. She described that when she started her own business, she had very little capital, and the factors that motivated her to decide to take out a loan from LOLC Cambodia were the reasonable interest rate and confidence in LOLC. She has already used three loan cycles since LOLC Cambodia was Thaneakea Phum to expand her current business.

Her business has now grown from a family business to a large one, with wholesale in the area. She shared that before becoming a successful businesswoman, she was a garment worker with a low monthly salary, but now she has her own strong and thriving business. This is due to the right decision to use LOLC Cambodia’s loans to expand the business, which means she can earn much more; it can be compared to the fact that her current daily income is equivalent to her monthly salary as a garment worker.

This progress made her able to complete the construction of her house completely and neatly prepared. In particular, she has become an influential person because she has a big business, combined with good communication and friendliness to customers.